10-Year DCF Analysis with Robust Sensitivity Tables and IRR

This is a very straight forward financial model with much work put into visuals and ease of use. It is also included in google sheets (link in template).

There are two tabs for summary analysis.

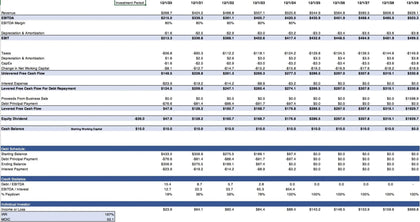

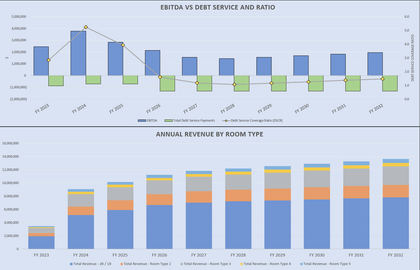

The first tab has 10 periods plus a year 0 input for cash expected to be contributed and cash expected to be returned. There are also inputs for 6 discount rates (required returns). Based on those inputs, the NPV (net present value) will be displayed for each discount rate. This is also displayed in a visual bar chart. The IRR (internal rate of return) of the expected cash flows is also displayed.

The second tab goes a step further and allows for scenario analysis. The user can input up to 4 cash flow streams. This could be to measure completely different projects side-by-side or different potential outcomes of the same project. Based on those 4 cash flow streams and 6 discount rates, 24 NPV will be displayed in a table. The table includes conditional formatting for +/- resulting NPV.

The coolest part of this model is the visual for the multiple scenario tab. It has a scatter plot style look to it where all 24 NPV are displayed for each scenario and each discount rate. Also, in the 2nd tab there are 4 different cash flow streams so that means 4 different IRR results as well. That is then displayed in a separate bar chart.

10-Year DCF Analysis with Robust Sensitivity Tables and IRR

Available:

In Stock

$45.00

This is a very straight forward financial model with much work put into visuals and ease of use. It is also included in google sheets (link in template).

There are two tabs for summary analysis.

The first tab has 10 periods plus a year 0 input for cash expected to be contributed and cash expected to be returned. There are also inputs for 6 discount rates (required returns). Based on those inputs, the NPV (net present value) will be displayed for each discount rate. This is also displayed in a visual bar chart. The IRR (internal rate of return) of the expected cash flows is also displayed.

The second tab goes a step further and allows for scenario analysis. The user can input up to 4 cash flow streams. This could be to measure completely different projects side-by-side or different potential outcomes of the same project. Based on those 4 cash flow streams and 6 discount rates, 24 NPV will be displayed in a table. The table includes conditional formatting for +/- resulting NPV.

The coolest part of this model is the visual for the multiple scenario tab. It has a scatter plot style look to it where all 24 NPV are displayed for each scenario and each discount rate. Also, in the 2nd tab there are 4 different cash flow streams so that means 4 different IRR results as well. That is then displayed in a separate bar chart.