Complete Multifamily Acquisition Financial Model

This is a ready-to-use multifamily acquisition financial model/pro forma.

This model was designed for a complete analysis of a real estate multifamily acquisition opportunity. This model can be used for an apartment/multifamily acquisition analysis OR multifamily property with a commercial unit(s).

In case you are looking for the financial model suitable for other property types, please contact me directly and I will be able to upload for you.

WHO IS THIS MODEL FOR?

If you are looking for a professional financial model which can deliver all the main economics of an investment WITHOUT giving you the headache of running through a million of unnecessary cells and unclear terminology, then my models are for you.

My models are also for those who are looking to present the investment opportunity to clients or investors in a clean and well-designed manner.

My models are also for those who wish to learn from the best practices.

MAIN ADVANTAGES OF THE MODEL

The best features of this model are its polished presentable dashboard as well as well-developed dynamic rent roll.

This model is both detailed and easy to use.

The model suits ideally for both value-add opportunities and buy-and-hold opportunities with minimum investment.

To make things as easy as possible for you.

This model is:

- Clean and transparent;

- Professional;

- Reliable;

- 100% dynamic;

- Easy to use, understand and modify;

- Prepared by an industry professional with a significant track record;

- Institutional quality;

- Presentable;

- Includes only useful information;

- Filling in all the dynamic inputs for the analysis takes less than 10 minutes.

The best thing is that I update my models non-stop, so after the purchase you are eligible to use a new version with added features and calculations.

MAIN PURPOSE OF THE MODEL

This multifamily acquisition model will help you to:

- Present main economics of an investment opportunity;

- Estimate rates of return and measure NPV for a multifamily acquisition;

- Measure operating, capital and financing costs;

- Present the cash flow of an investment;

- Perform valuation of an investment property;

- Assess the feasibility of the refinancing option and an amount of taking out;

- Assess a range of rental and exit scenarios;

- Assess a range of financing options.

MAIN CONTENTS

The package includes 1 Unlocked Excel File + 1 Detailed Video Instructions Guide (30-40min)

This model is suitable for investors looking at multifamily and mixed-use acquisition projects. Or it might also serve analysts or prospective analysts looking to improve their modeling skills.

The model is fully dynamic and allows for a detailed analysis of a multifamily or mixed-use (apartments + single tenant commercial unit) property types.

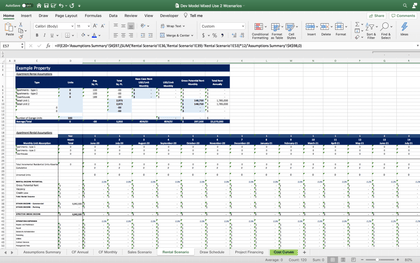

The model consists of 6 interconnected tabs.

The contents are as follows:

- Assumptions Tab: flexible acquisition and exit dates, mortgage financing assumptions, re-financing assumptions, acquisition costs, growth rates, and sale costs assumptions.

-The renovation schedule based on the number of units renovated and flexible timing of renovation.

- Dashboard Tab: Includes 10 years of monthly cash flow, a summary of costs and revenues, 2 charts and main metrics summary: IRR, Equity Multiple, Profit Margin, Net Profit, DSCR, Debt Yield, Operating Margin, Cash on Cash, NPV, DCF.

- Annual Cash Flow: includes operating revenues, operating costs, NOI, capital costs (leasing fees and CAPEX), debt service, and net income.

- Monthly Cash Flow.

- Rent Roll with a flexible number of units. Projection of the operating expenses and additional income.

- Historical Performance tab with calculated T3, T6, T12. Allows sorting the historical income statement into the cost categories used in future projections.

- Project Financing with senior debt amortization, re-financing option, supplemental loan option, and mezzanine financing.

KEY OUTPUTS

- Cost/Sqft (Sqm), Sale Price/Unit, Net Rental Revenue;

- NOI, Debt Service, Net Leveraged Cash Flow;

- NPV, DCF Valuation;

- DSCR, Cash on Cash Return, IRR, Equity Multiple, Net Profit.

- Exit value for the property is calculated automatically based on NOI for a period and cap rate you assume in your projection.

In case you have any questions or concerns before purchase, please feel free to contact me directly.

If you have specific requirements for the model or need a consultation, please also contact me.

Shall you have any suggestions for upgrading or adjusting my models so that they suit you and my audience better, please let me know.

This model was designed for a complete analysis of a real estate multifamily acquisition opportunity. This model can be used for an apartment/multifamily acquisition analysis OR multifamily property with a commercial unit(s).

In case you are looking for the financial model suitable for other property types, please contact me directly and I will be able to upload for you.

WHO IS THIS MODEL FOR?

If you are looking for a professional financial model which can deliver all the main economics of an investment WITHOUT giving you the headache of running through a million of unnecessary cells and unclear terminology, then my models are for you.

My models are also for those who are looking to present the investment opportunity to clients or investors in a clean and well-designed manner.

My models are also for those who wish to learn from the best practices.

MAIN ADVANTAGES OF THE MODEL

The best features of this model are its polished presentable dashboard as well as well-developed dynamic rent roll.

This model is both detailed and easy to use.

The model suits ideally for both value-add opportunities and buy-and-hold opportunities with minimum investment.

To make things as easy as possible for you.

This model is:

- Clean and transparent;

- Professional;

- Reliable;

- 100% dynamic;

- Easy to use, understand and modify;

- Prepared by an industry professional with a significant track record;

- Institutional quality;

- Presentable;

- Includes only useful information;

- Filling in all the dynamic inputs for the analysis takes less than 10 minutes.

The best thing is that I update my models non-stop, so after the purchase you are eligible to use a new version with added features and calculations.

MAIN PURPOSE OF THE MODEL

This multifamily acquisition model will help you to:

- Present main economics of an investment opportunity;

- Estimate rates of return and measure NPV for a multifamily acquisition;

- Measure operating, capital and financing costs;

- Present the cash flow of an investment;

- Perform valuation of an investment property;

- Assess the feasibility of the refinancing option and an amount of taking out;

- Assess a range of rental and exit scenarios;

- Assess a range of financing options.

MAIN CONTENTS

The package includes 1 Unlocked Excel File + 1 Detailed Video Instructions Guide (30-40min)

This model is suitable for investors looking at multifamily and mixed-use acquisition projects. Or it might also serve analysts or prospective analysts looking to improve their modeling skills.

The model is fully dynamic and allows for a detailed analysis of a multifamily or mixed-use (apartments + single tenant commercial unit) property types.

The model consists of 6 interconnected tabs.

The contents are as follows:

- Assumptions Tab: flexible acquisition and exit dates, mortgage financing assumptions, re-financing assumptions, acquisition costs, growth rates, and sale costs assumptions.

-The renovation schedule based on the number of units renovated and flexible timing of renovation.

- Dashboard Tab: Includes 10 years of monthly cash flow, a summary of costs and revenues, 2 charts and main metrics summary: IRR, Equity Multiple, Profit Margin, Net Profit, DSCR, Debt Yield, Operating Margin, Cash on Cash, NPV, DCF.

- Annual Cash Flow: includes operating revenues, operating costs, NOI, capital costs (leasing fees and CAPEX), debt service, and net income.

- Monthly Cash Flow.

- Rent Roll with a flexible number of units. Projection of the operating expenses and additional income.

- Historical Performance tab with calculated T3, T6, T12. Allows sorting the historical income statement into the cost categories used in future projections.

- Project Financing with senior debt amortization, re-financing option, supplemental loan option, and mezzanine financing.

KEY OUTPUTS

- Cost/Sqft (Sqm), Sale Price/Unit, Net Rental Revenue;

- NOI, Debt Service, Net Leveraged Cash Flow;

- NPV, DCF Valuation;

- DSCR, Cash on Cash Return, IRR, Equity Multiple, Net Profit.

- Exit value for the property is calculated automatically based on NOI for a period and cap rate you assume in your projection.

In case you have any questions or concerns before purchase, please feel free to contact me directly.

If you have specific requirements for the model or need a consultation, please also contact me.

Shall you have any suggestions for upgrading or adjusting my models so that they suit you and my audience better, please let me know.