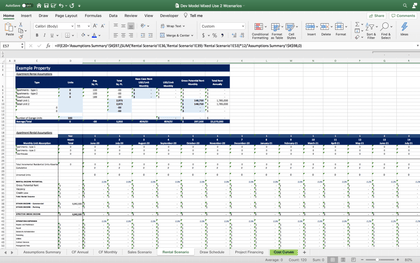

Industrial Development Real Estate Financial Model Excel Template

Model Highlight

Five-year horizon cash flow proforma for the industrial development real estate business for early-stage startups to impress investors and raise capital. Industrial Development Real Estate Budget Spreadsheet helps to estimate required startup costs. Unlocked - edit all - last updated in Sep 2020.

Model Overview

All necessary reports and calculations, including industrial development real estate all in one dashboard of your start-up, are displayed on a convenient industrial development real estate dashboard. You do not need to move between sheets to compare important data - everything is visible immediately.

FINANCIAL MODEL ADVANTAGES

- Easily Model Industrial Development Real Estate Income Statement And Balance Sheet

- Is An Important Discipline Of Financial Planning

- Compute A Startup Costs With Industrial Development Real Estate Business Plan Pro Forma Template Excel

- Gaining Trust From Stakeholders

- Establish Milestones With Industrial Development Real Estate Cash Flow Proforma

- Document Your Industrial Development Real Estate Revenue Model

- Be Able To Project Forward How Much Cash You'Ll Have

- Understand The Impact Of Future Plans And Possible Outcomes

INDUSTRIAL DEVELOPMENT REAL ESTATE FINANCIAL PROJECTION MODEL EXCEL KEY FEATURES

Simple and Incredibly Practical

Simple-to-use yet very sophisticated Industrial Development Real Estate Cash Flow Format In Excel. Whatever size and stage of development your business is, with minimal planning experience and very basic knowledge of Excel you can get complete and reliable results.

Better decision making

Make better operational decisions with the help of creating Cash Flow scenarios in your Excel Template. Perhaps you have to choose between new staff members or investment in equipment, and you are wondering which decision to chose. Variants forecasting will give you the information you need to make these decisions with confidence that you know what impact they will have on your cash balance.

We do the math

Have all the features above ready with no formulas writing, no formatting, no programming, no charting, and no expensive external consultants! Concentrate on the task of planning rather than programming.

It is part of the reports set you need.

It doesn't matter you are worried about cash or not, setting up, and managing a Industrial Development Real Estate Pro Forma Budget should be a cornerstone of your reporting set. It's the main report of your business that must have in place to grow sustainably. Before you rush into rent more office space or making a new hire, you should always run a Cash Flow scenario. You can model how that action would impact your cash balance in the nearest future. Knowing whether or not plans are possible is crucial to minimizing risk.

Simple-to-use

A very sophisticated Industrial Development Real Estate Financial Projection, whatever size and stage of development your business is. Minimal previous planning experience and very basic knowledge of Excel is required: however, fully sufficient to get quick and reliable results.

Save time and money

Via business plan in Excel you can without effort and special education get all the necessary calculations and you will not need to spend money on expensive financial consultants. Your task is building a strategy, evolution, and creativity, and we have already done the routine calculations instead of you.

WHAT WILL I GET WITH INDUSTRIAL DEVELOPMENT REAL ESTATE EXCEL FINANCIAL MODEL TEMPLATE?

Profitability KPIs

EBITDA. Earnings before interest, tax, depreciation, and amortization (EBITDA) is a financial metric that shows a company's profitability. This metric includes both monetary and non-monetary items and, therefore, differs from cash flows. EBITDA shows the potential profitability of leveraged buyouts and is widely used in various industries.

Performance KPIs

Return on capital. The return on capital reflects the correspondence of the Balance Sheet and Income Statement. Return on capital measures the accomplishment of earnings to the capital employed. Companies with good financial management have good returns.

Financial Statements

Our Industrial Development Real Estate Startup Financial Model has pre-built consolidated financial statements: p&l forecast, Balance Sheet, and cash flow forecast. These financial statements can be presented on a monthly, quarterly, and annual basis. Users can also import existing financial statements and reports from Quickbooks, Xero, Freshbooks, and other accounting software to create rolling forecasts and to make actuals vs. forecasts comparison.

Financial KPIs

You can visually track your key financial indicators (KPIs) for 24 months and up to five years. The model all KPIs you might need for your company: - EBITDA/EBIT shows your company's operational performance; - CASH FLOWS show your company's inflows and outflows; - CASH BALANCE this is the forecast of cash in hand you will have.

Valuation

With our Industrial Development Real Estate Cashflow Projection, you will get proformas for valuation analysis. You will be able to perform a Discounted Cash Flow (DCF) valuation analysis and other valuations you may need.

Break Even

Break-even analysis in economics, business, and cost accounting helps calculate the point of time in which the company's total cost and total revenue are expected to become equal. Companies use a break-even point analysis to determine the number of product units they need to sell or revenue needed to cover total (fixed and variable) costs. This Industrial Development Real Estate Three Statement Financial Model Template will also help determine the sales prices for the company's products. Sales cost per unit less variable cost per unit shows the contribution margin and the contribution margin impacts company's profitability.

Loan opt-in

Similar to the amortization of the assets, a loan amortization reflects the spreading out the repayment of a loan for a certain period that covers several reporting periods. The process of loan amortization includes a series of fixed payments over time. Usually, companies make these payments on a monthly basis, but there may also be quarterly or annual payments.