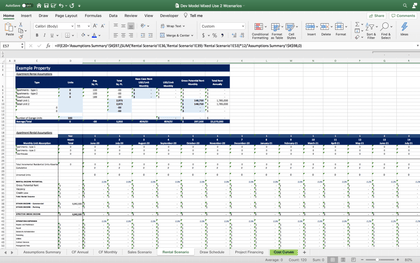

Self-Storage Development Real Estate Financial Model Excel Template

Model Highlight

Five year self-storage development real estate cash flow proforma template for fundraising and business planning for startups and entrepreneurs. Key financial charts, summaries, metrics, and funding forecasts built-in. Created with the mind of the self-storage development real estate business. Self-Storage Development Real Estate Three Statement Financial Model helps to estimate required startup costs. Unlocked - edit all - last updated in Sep 2020.

Model Overview

The self-storage development real estate financial model includes all required forecasting reports, including assumptions, projected income statement (p&l forecast), statement of cash flows, balance sheet, performance KPIs, and financial summaries for months and years (incl. numerous graphs and KPIs).

FINANCIAL MODEL ADVANTAGES

- Anticipate The Impact Of Upcoming Changes

- Schedule Your Startup Loan’S Repayments With Self-Storage Development Real Estate Financial Model

- Assess The Feasibility Of Your Idea With Self-Storage Development Real Estate Budget Spreadsheet

- Set New Goals With Self-Storage Development Real Estate Financial Model In Excel Template

- Identify Your Strength And Weaknesses

- Choose One Of 161 Currencies For Settlements

- Compute A Startup Costs With Self-Storage Development Real Estate Budget Financial Model

- Plan The Costs For Opening Self-Storage Development Real Estate And Operating Activities

SELF-STORAGE DEVELOPMENT REAL ESTATE P&L PROJECTION KEY FEATURES

Gaining trust from stakeholders

Investors and financing providers tend to think in terms of the big picture. They want the c-level of the companies they invest in to do the same to ensure they maintain a clear idea of the future. Providing stakeholders with a monthly cash flow statement proforma will demonstrate a level of awareness that leads to confidence and trust and will make it easier to raise more investment.

Saves you time

Allows you to spend less time on finances and more time on your products, customers and business development

Plan for Future Growth

Projected Cashflow Statement can help you plan for future growth and expansion. No matter you're extending your company with new employees and need to take into account increased staff expenses. Or to scale production to keep up with increased sales, future projections help you see accurately where you're running — and how you'll get there. Forecasting is also a well-known goal-setting framework to help you plan out the financial steps your company has to take to reach targets. There's power in Cash Flow Projection and the insight they can provide your business. Fortunately, this competitive advantage comes with little effort when you use the Cash Flow Statement.

Get a Robust, Powerful and Flexible Financial Model

This well-tested, robust and powerful Self-Storage Development Real Estate Financial Projection Excel is your solid foundation to plan a business model. Advanced users are free to expand and tailor all sheets as desired, to handle specific requirements or to get into greater detail.

Manage accounts receivable.

By creating a projected cash flow statement that takes invoices and bills into account, you'll be more easily able to identify who is systematically paying late. You could even go on to model different payment dates on overdue invoices to see the real effect of late payments on your cash flow.

Predict the Influence of Upcoming Changes

Does your company plan to purchase new equipment or to launch a new product? Startup Cash Flow Statement enable you to obtain a complete picture of the effect that specific changes will have on your cash flow. When planning your finances in the Projected Cash Flow Statement Format, you will forecast cash inflows and outflows based on future invoices, bills due, and payroll. You can then create multiple 'what if' scenarios, such as buying new equipment to choose the best way for you. Forecasting shows you how the upcoming changes will affect your cash balance.

WHAT WILL I GET WITH SELF-STORAGE DEVELOPMENT REAL ESTATE FINANCIAL PROJECTION MODEL?

Cash Flow KPIs

Cash conversion cycle (CCC). The cash conversion cycle (CCC) is a financial metric that expresses the time it takes for a company to convert its resources in the form of inventory and other resources into cash flows. The cash conversion cycle is also called the Net Operating Cycle. CCC measures how long each dollar that the company inputted is tied up in the production and sales process before it gets converted into cash. The cash conversion cycl metric accounts for various factors, such as how much time it takes to sell inventory, how much time it takes to collect accounts receivable, and how much time it takes to pay obligations.

Profitability KPIs

EBIT. Earnings before interest and tax (EBIT) is a measure of a company's earning power from ongoing operations, equal to earnings before deduction of interest payments and income taxes. EBIT shows the operating performance of the company that excludes income and expenditures from unusual and non-operational activities.

Costs

Our Self-Storage Development Real Estate Financial Model In Excel Template has a well-developed methodology for creating a cost budget. You can plan and forecast your costs from operations and other expenses for up to 60 months. The cost budget has a detailed hiring plan while also automatically handling the expenses' accounting treatment. You can set salaries, job positions, and the time of hiring. Moreover, the model allows users to calculate hiring as the company scales automatically. Pre-built expense forecasting curves enable users to set how an expense changes over time. These pre-built options include % of revenues, % of salaries, % of any revenue category, growth (or decline) rates that stay the same or change over time, ongoing expenses, expenses that periodically reoccur, expenses that regularly change, and many more. Costs can be allocated to key expense areas and labeled for accounting treatment as SG&A, COGS, or CAPEX.

Liquidity KPIs

Accounts receivable turnover (ART). The accounts receivables turnover ratio (ART) is a metric that assesses a company's effectiveness in collecting its receivables. This ratio shows how successful the company is in managing its debts.

Loan opt-in

Our Financial Model In Excel Template has a built-in loan amortization schedule with both the principal (i.e., the amount of loan borrowed) and the interest calculation. A loan amortization schedule template will calculate your company's payment amount, including the information on the principal, interest rate, time length of the loan, and the payments' frequency.

Cap Table

The Self-Storage Development Real Estate Cash Flow Proforma has built-in proformas to calculate discounted cash flows and various sales' and EBITDA valuations. Business owners can use these valuations to assess the exit value and perform the financial projections of returns to investors. Users can use the Cap table or ignore it; it will not have a negative impact on the other financial calculations in the model.

Benchmarks

A benchmark study calculates the company's key performance indicators, either business or financial, and finds an industry-wide average as a comparison. The industry average metrics are then used to determine the relative value for benchmarking analysis. Financial benchmarks are essential for the financial planning of the companies, especially for start-ups. These studies help companies determine the 'best practice' companies within the industry and compare their own financial results with these best practices. It is a useful financial and strategic management tool.