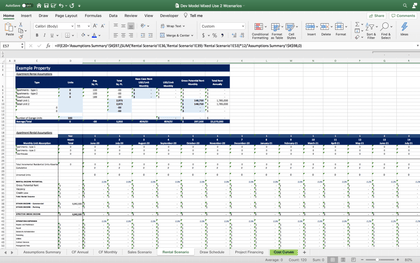

Free Cash Flow Real Estate Valuation Excel Model

This Free Cash Flow Real Estate Valuation template is a tool for creating a 10-year business plan for a real estate company, as well as estimate enterprise and equity values under certain assumptions.

With this Free Cash Flow Real Estate Valuation template you will be able to:

-> Use assumptions in the Income Statement & Balance sheet to automatically create a Cashflow Statement

-> Calculate WACC, either manually or using CAPM (Capital Asset Pricing Model assumptions for a real estate company operating in the US market are included)

-> Determine the worth of the company in the separate worksheet for valuation, which displays FCFF (Free Cash Flow to Firm) for each year, terminal firm value

-> Perform sensitivity analysis for the company value to assumptions of WACC and terminal growth rate

-> Calculate detailed projections of financing activities and capital expenditures

The Free Cash Flow Valuation template includes the following worksheets:

-> P&L (Income Statement)

-> BS (Balance Sheet)

-> CF (Cash Flow)

-> Operating Revenue

-> Financing

-> Capital Expenditures

-> WACC (Weighted Average Cost of Capital)

-> Valuation

These are effective reporting and analysis sheets that are adapted for a real estate business scenario. These sheets can be adjusted to your company's specific needs.

Let us do the work for you!

Feel free to contact our team in case you need support with budgeting your company. Our team provides financial modeling services to companies around the world. Actually, this is our core business. We have a lot of experience with creating budgets for service companies and know the specifics of the business.